By Tim Rayden, Laura Doughty and Elizabeth Beall

26 September 2024

We cannot overstate the critical role forests play in combating climate change – absorbing around 25% of carbon dioxide emissions – and providing a home to 80% of all biodiversity on land. More broadly, nature is crucial to positive development pathways - underpinning $44 trillion of economic value generation, over half of the world's GDP!

Thanks to Professor Sir Partha Dasgupta and others, we have started to understand the impacts of forest loss and degradation on the global economy, from increased spending on flood defences, falling agricultural productivity, changing rainfall patterns, and air pollution.

After last year’s wildfires blanketed smoke over New York City and record fires in the Amazon this year, we are seeing nature climbing up the agenda as the world convenes at the UN headquarters this week.

Nature protection and restoration is cemented in ambitious new commitments laid out in the Global Biodiversity Framework. Signatory countries are committed to ensure 30% of degraded ecosystems are being restored by 2030. But it is a huge challenge to make this happen. Public finance to deliver on these commitments is limited, so the gap can only be filled by mobilizing more private capital for nature.

Private finance for ‘Nature-based solutions’ and ‘ecosystem services’ is growing. That can mean money for carbon sequestration or improved water quality or flood management. The environmental and social outcomes that nature, including forests, provide have been taken for granted in the past, but are increasingly seen as critical infrastructure in need of investment. These can, and should, be priced into commodity investments. And yet, private capital accounted for only 17% of global investment in ecosystem services in 2023.

Why smart regulation is needed to grow private capital for nature

Regulation plays a crucial role in stimulating the flow of private capital towards nature-based solutions, but it must be strategically targeted. Recent regulations on deforestation-free sourcing have successfully driven investments into sustainable supply chains, mainly product traceability. But traceability is only part of the solution. Agricultural expansion, the primary driver of deforestation, continues unchecked, underscoring the need for solutions at a landscape level.

The good news is there are a range of voluntary frameworks and guidance which can support collective action across landscapes and lay the groundwork for regulation to come. The Science Based Targets for Nature (SBTN, forming part of the Science Based Targets initiative) define how companies can assess, prioritise, measure, address, and track their impacts and dependencies on nature. This will help companies prioritise where to act.

Crucially, the SBTN has introduced a land sector target for companies to engage in landscape level initiatives. This provides a route for companies to engage with efforts to address pressures within and beyond their direct value chains. Commodity producing landscapes are a complex mix of land uses that interact with, and impact on, natural resources and the SBTN has recognised this. Just this week they have published the outcomes of their year-long corporate pilot programme. This report provides insights into how the six pilot companies engaged with the target-setting process.

Solutions for companies - building collective action in landscapes

Many companies do understand the risk of forest degradation, and they want solutions. They just don’t want to invest unilaterally in ecosystem services and local livelihoods if they are not the only company operating in that region. This is strengthening the call to act collectively at a landscape scale, building on opportunities to solve shared challenges in a way that business, and forest communities, all gain.

Pre-competitive collaboration to reverse degradation might sound like a pipe dream, but it’s already happening. The Cocoa and Forests Initiative was a pioneer in this space, fostering these landscape-level efforts in cocoa growing regions of west Africa. It brought together public and private sector actors to collaborate and address systemic issues while reversing deforestation.

Trillion Trees has teamed up with Finance Earth to build more land restoration collaborations across a wide range of biodiversity conservation landscapes and commodity sectors.

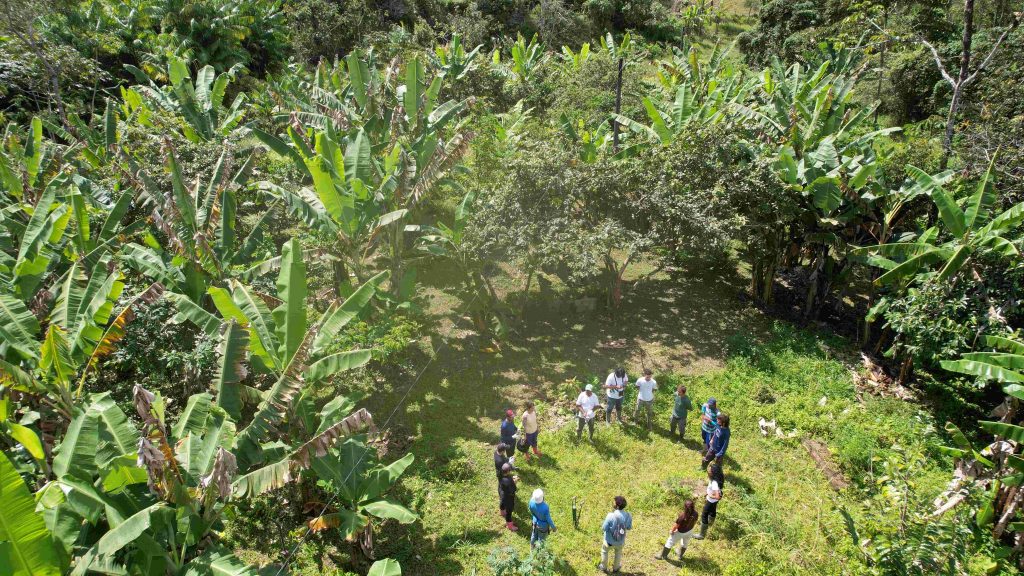

In the Atlantic Forest in Brazil, stakeholders active in soy, cattle, sugar cane and coffee are committed to adopting regenerative practices in their agricultural production alongside forest protection and restoration activities. The initiative, which is facilitated by WWF-Brasil, is already part of a UN World Restoration Flagship Landscape. Trillion Trees has been supporting WWF-Brasil and its partners to develop a scalable restoration strategy and business models to tackle underlying conservation challenges and incentivize farmers to protect and restore natural forest on their properties.

In South Sumatra, coffee producers operating on the border of Bukit Barisan Selatan National Park are looking for ways to scale up the adoption of agroforestry systems and restore degraded land with forest planting. Trillion Trees partner WCS has brought them together under the Bukit Barisan Selatan Sustainable Commodities Partnership to improve their business resilience and climate and nature footprints without shifting their sourcing contracts. Investors are poised to engage and are seeking high-integrity opportunities to restore forest, while increasing the sustainability of coffee production and supporting farmer livelihoods.

The pieces of the puzzle – on the ground commitment, enabling regulation, corporate demand and investor interest – are all starting to fall into place. To build momentum and deliver these solutions at the scale needed to deliver the targets set in Paris, Kunming and Montreal, we now need to deploy capital to these and other promising landscape initiatives.

The Forest Restoration Catalyst

The Trillion Trees Forest Restoration Catalyst (FRC) aims to make that easier. The FRC is a landscape preparation facility that will support collective actions beyond the value chain to address, and reverse, the drivers of degradation. The FRC helps by

- Pooling funds from corporates, government, and philanthropic sources with a shared interest in the landscape to support and scale high quality restoration;

- Providing a rigorous monitoring, reporting and verification framework to track outcomes for people, nature, and climate at the landscape level; and

- Adapting support to each specific landscape’s needs while providing capacity exchange and learning across multiple geographies.

To really move the dial, investment in forest landscape restoration can no longer be categorised as Corporate Social Responsibility, or a sunk cost. Instead, the value that forest landscapes provide must be added to the sourcing strategies and accounting of every company dependent on forest landscapes. Only then will the trees be appreciated for just how much they can make money grow.

Tim Rayden is Lead, Forest Landscape Restoration, WCS

Dr. Laura Doughty is Forest Restoration Catalyst Manager, WWF-UK

Elizabeth Beall is Managing Director, Finance Earth

Trillion Trees is the united force of BirdLife International, Wildlife Conservation Society and WWF. Together we protect and restore forests all over the world - for the benefit of people, nature and the climate. If you would like to learn more about the FRC, please contact action@trilliontrees.org. To learn more about how we're improving forest protection, advancing restoration and ending deforestation visit trilliontrees.org

Finance Earth is a mission-driven social enterprise, working in partnership with world leading environmental organisations to protect and restore nature utilising market based mechanisms and implementing bespoke financial tools.